Bond notes still legal tender

Share

By Sharon Chimenya

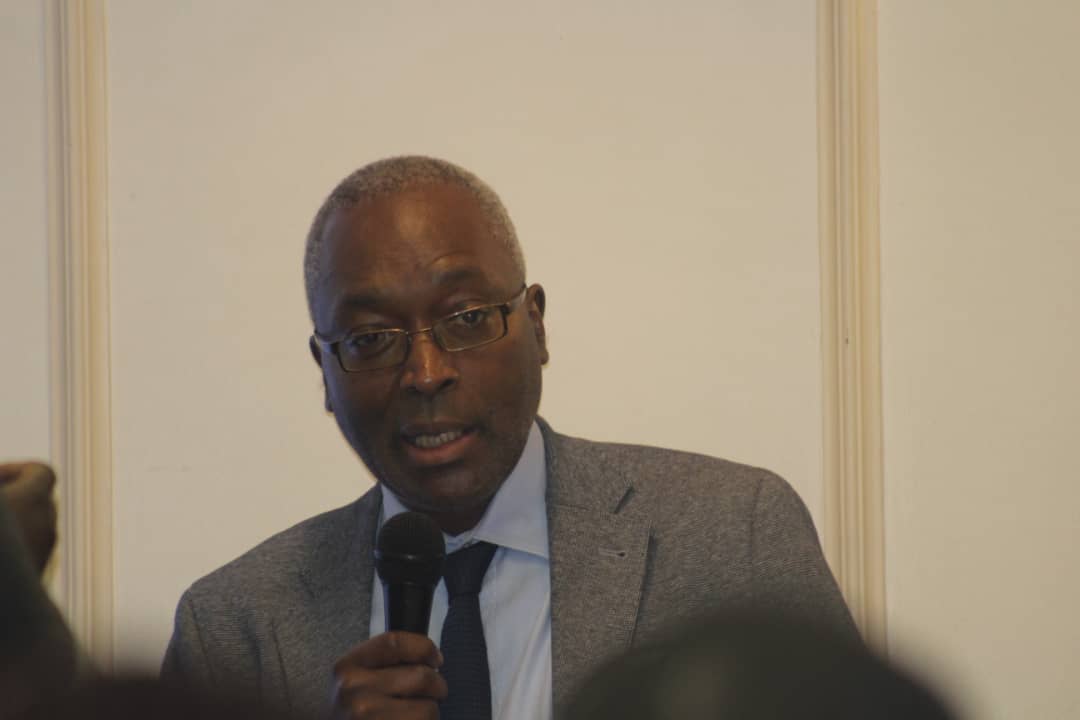

THE Governor of the Reserve Bank of Zimbabwe (RBZ), Dr John Mushayavanhu, has said bond notes are still legal tender, and individuals have until Tuesday to deposit the notes at the banks.

Dr Mushayavanhu was speaking at a business breakfast meeting in Masvingo on Friday, encouraged members of the public to disregard social media and follow updates from the central bank.

He said, contrary to the social media, which had declared April 30 as the deadline for the bond notes, people had up to May 7 to bring in the bond notes and receive their value in ZiG.

“There might have been some confusion yesterday, when I said bond notes are a legal tender right now. Yes, it is true. Please do not listen to social media lawyers. We have lawyers in the central bank, seasoned lawyers, and lawyers of many years standing. The Statutory Instrument is very clear that if you have a bond note now you can go to the bank and surrender it,” he said.

“They wanted to give an impression that after April 30 the bond notes was now useless and you can throw it in the river. You have until the 7th of May to bring the bond note to the bank and you will be given value in ZiG to either be credited in your account or in cash.”

He said People could say whatever they wanted on social media but, they needed to do research first.

“Social media can say what they want, but they ought to research. There are lawyers who claim to be lawyers, but don’t listen to social media lawyers; listen to what we say because it is us who introduced this currency. It is us who go to the Statutory Instrument that brought the currency to be issued,” he said.

Meanwhile the RBZ Governor has said they were off on a good start following the introduction of the ZiG currency and pledged transparency on the reserves in the central bank.

The Government introduced the gold backed ZiG currency in April, with bank notes and coins being eased into circulation early last week, bringing relief to the business community and members of the public.

Speaking during a breakfast meeting organised by the Zimbabwe National Chamber of Commerce (ZNCC) on Friday, Dr Mushayavanhu said the 2,5 million gold reserves was not a lot but was their starting point.

He said the ZiG that is in circulation is around Z$1 billion, which was worth around US$90 million, and at the time they announced the monetary policy they had US$100 million in balances and as of last Friday they had US$185 million against US$80-90 million worth of ZiG.

“What has changed this time around is that we now have a currency which is fully backed by reserves, reserves in the form of gold, reserves in form of other precious minerals and reserves in the foreign currency that we have as the central bank. We were bold enough to call His Excellency the President on the 4th of April to come and inspect the vaults at the central bank for all to see the gold that is there,” he said.

“It is not a lot of gold when you compare with gold that is in the vaults of the Bank of England and others but that’s where we are starting from. We are starting with 2,5 tonnes of gold worth US$185 million. We are also starting with US$100 million in our bank accounts versus around US$90 million worth of ZiG in circulation.”

The reserves they have were covered and they would not go about printing more money.

“We are more than three times covered. That should be a good start and we have learnt from the past. If it was that easy that nations could just print currency and they become prosperous we would all be rich nations. There won’t be a third world country but it is not as easy as that and we have learnt our lesson in the past.”

He said the bond note was covered by a facility but the facility was a finite amount and over time they would allow money supply to grow beyond the cover, which in turn resulted in the challenges of inflation and currency instability.

“This is why we are saying we have to walk the talk. We are going to make sure every year the reserves that we have in the central bank in the form of gold, in the form of US$ balances are audited and the results are made public.

“Over and above, we are currently on a daily basis monitoring the movement on the money in circulation. We have introduced the Governor’s daily dashboard, without fail at 4pm I will get all these things coming through, this is the amount of money in circulation, this is what banks have created by way of loans and overdrafts this is the amount we have in reserves. If anything moves in the wrong direction, we quickly act to make sure it is corrected,” he said.