Chamber of Mines welcomes extension of multi-currency regime

Share

Bulawayo (New Ziana)-The Zimbabwe Chamber of Mines on Friday commended the recent move by the government to extend to 2030 the tenure of the multi-currency regime from the initially planned cut off period of 2025, saying this will allow its members to raise capital from local financial markets.

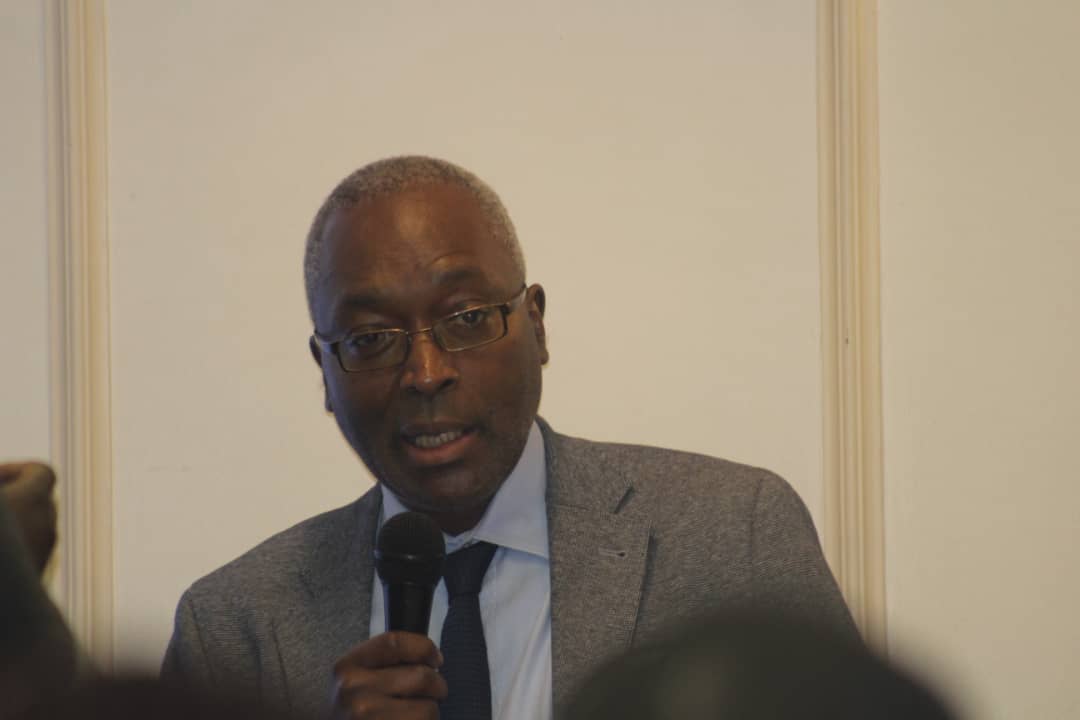

Speaking at the State of the Mining Industry Report Breakfast Seminar, Chamber of Mines chief executive officer Isaac Kwesu said their members have been facing challenges to raise capital within local financial markets due to uncertainty by banks over the fate of foreign currency after 2025.

The US dollar will now remain an integral part of Zimbabwe’s payment system until 2030 after the government extended the tenure of the multi-currency regime, a development that will boost investor confidence and bring certainty to planning by business.

“As the Chamber, we welcome the extension of the multi-currency regime to 2030,” said Kwesu.

“We are happy that we would be able to access local funding and commence with our business models which are long term in nurture. This is something that we applaud government to have saved the situation not to just wait for the 2024 budget announcement, but they have responded to our call-in time.”

He said in the last 12 months, their members were facing challenges in their efforts to raise capital due to the multi-currency framework which was provided in the law that it will end in 2025.

In June last year, the government promulgated Statutory Instrument (SI) 118 of 2022, which provided for the multi-currency system to run for five years. The SI entrenched into law the multi-currency regime for the

entire period of the National Development Strategy (NDS1), a five-year economic blueprint adopted by Government in 2020 and runs through to December 2025.

“We were already struggling with something that miners were already crying about which is to raise capital from the local financial markets and the banks had shortened the terms of loans from long term and it was

not making sense,” said Kwesu.

He also applauded bankers in the country for presenting the issue before Parliament, saying the intervention saved the situation.

He however bemoaned the lack of capacity by local banks to adequately provide long term capital to the industry.

“Their funds remain predominantly transitory, its short term in nature and this is equally affecting us as the mining sector. We need long term loans to adequately retool and increase productivity,” he said.

New Ziana

Page 1 of 1