Government widens electronic tax minimums

Share

Harare (New Ziana) – Government on Thursday increased the minimum taxable amounts for intermediated money transfer tax (IMTT), better known as the two percent tax, to $100 from $20 per transaction for individuals as it sought to ease the burden on low income earners.

The review takes effect from January next year.

The tax, which was introduced last year to spirited public opposition, has now widely been accepted after government insisted it would not go away.

President Emmerson Mnangagwa at the time described the tax as a “necessary pain.”

The IMTT spawned a higher demand for bank notes as people sought to avoid paying it.

Funds collected from the tax have been used to fund emergency programmes as well as other critical social programmes.

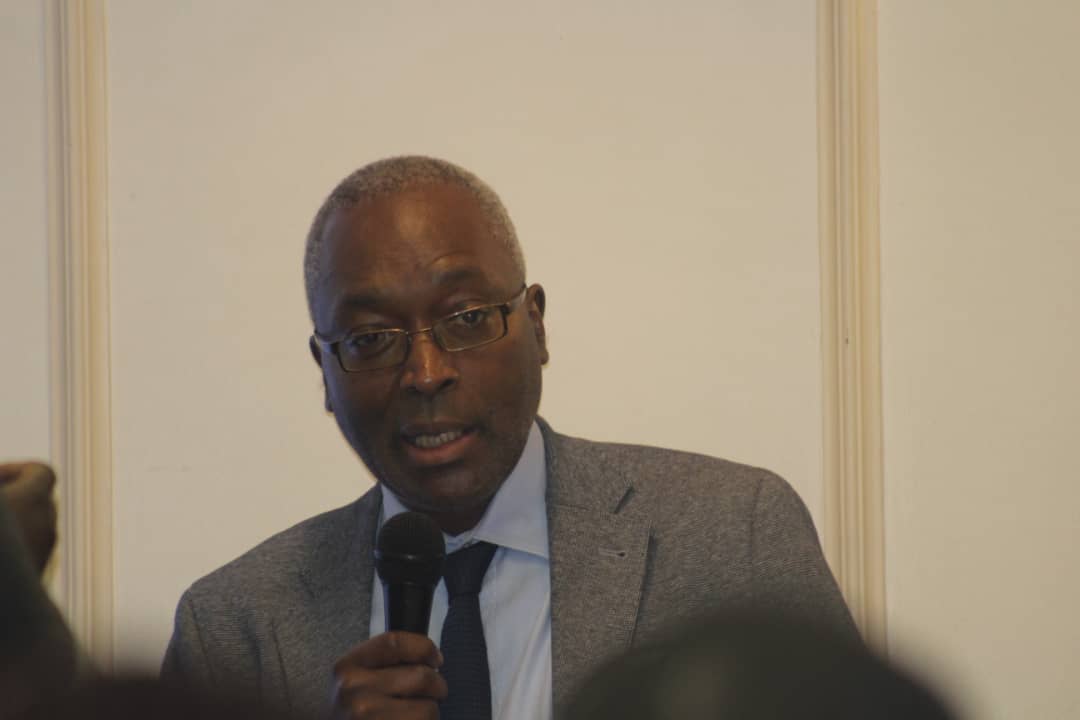

Finance and Economic Development Minister, Professor Mthuli Ncube, presenting the 2020 National Budget in Parliament, said the tax had managed to force other sectors, which generally escaped paying tax, from making a contribution to the fiscus.

“In order to cushion low income earners and high volume businesses, I

propose to review the Tax-Free Threshold from the current ZWL$20 to ZWL$100 and the maximum tax payable per transaction by corporates from the current ZWL$15 000 to ZWL$25 000 on transactions with values exceeding ZWL$1 250 000, with effect from 1 January 2020,” he said.

Prof Ncube said payments relating to remuneration were already exempt from IMTT, and the exemptions would be widened to include social transfers to the under-privileged by development partners.

“Furthermore, for the avoidance of doubt, all other bulk payments through mobile money banking platforms attract intermediated money transfer tax,” he said.

New Ziana