NetOne extends zero-tarrif money service

Share

Harare, (New Ziana) – State owned telecommunications firm, Net One said on Thursday it was extending its free mobile money service by three months to end of March 2020 as it continues to entice subscribers to dump its troubled competitor, Ecocash.

The telco, late last month scrapped service charges on its mobile money platform, One Money to boost its share of the mobile money market after Ecocash, which enjoys a lion’s share of the market, ran into serious problems that led to some businesses temporarily abandoning its usage.

Third quarter statistics released by the telecoms sector regulator, the Postal and Telecommunications Regulatory Authority of Zimbabwe, last week show that One Money managed to boost its market share to 23.7 percent from 22.3 percent, with the number of its active subscribers jumping to 3.04 million from 2.752 million in the previous quarter.

But the full effects of the campaign to entrench itself since Ecocash’s troubles started mid-November will likely be reflected when the fourth quarter data is made available.

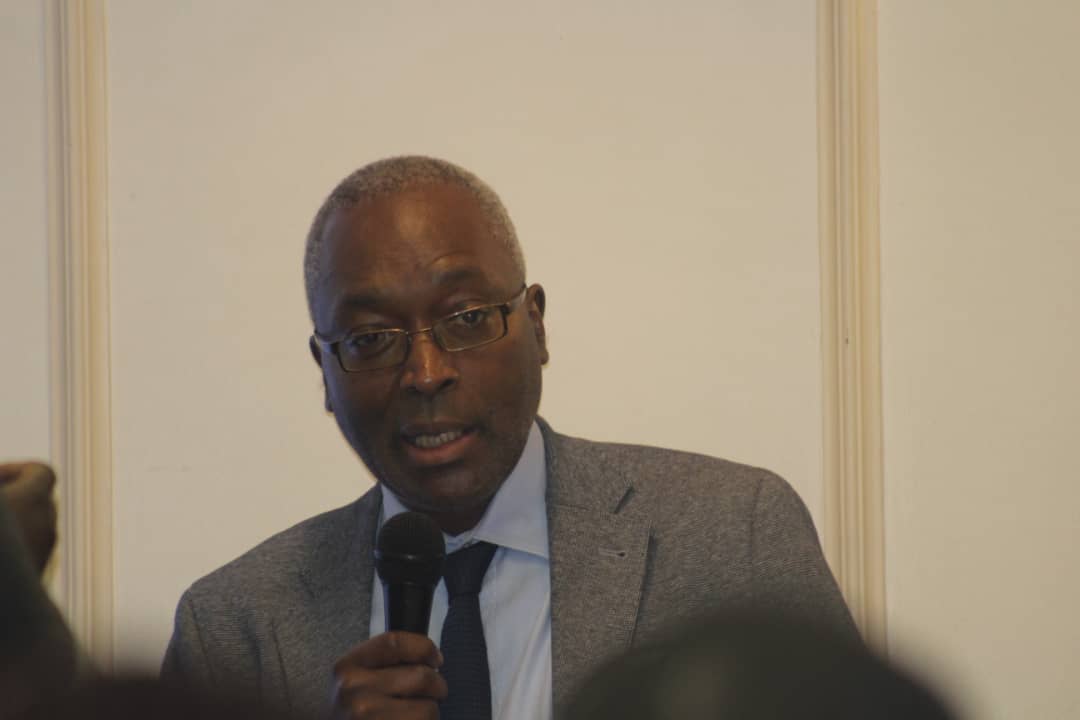

Net One chief executive, Lazarus Muchenje said extension of the “free”

service offering was due to public demand.

“By popular demand, we are extending our zero tariff promotion on One

Money to assist you, the transacting public in the difficult months of

January through to March,” he said.

“For the three months of 2020, you will still be able to transact for free.”

Under the promotion, subscribers, who have complained about the high cost of mobile money services, only pay the obligatory two percent tax and card swiping charges, with the company voluntarily forfeiting its charges.

Subscribers will be able to pay, send and receive money without being

charged.

Over a month after its system update, Ecocash is not totally reliable as before, with subscribers still complaining about losing money after

transactions are not completed, now commonly referred to as “hanging

transactions.”

Some businesses and retailers are telling customers to pay using the

platform at their own risk in case a transaction fails to complete but

their accounts are still debited.

At the end of the third quarter of 2019, Ecocash’s market share of the

mobile money market was down to 68.1 percent from 69.4 in the previous

quarter.

Mobile money platforms gained popularity in the last few years due to

their convenience, and also because of cash shortages.

New Ziana