RBZ keeps interest rate at 35%

Share

Harare, (New Ziana) – The Reserve Bank of Zimbabwe (RBZ) on Monday left the overnight accommodation rate unchanged at 35 percent, and forecast annual inflation to close the year at around 50 percent.

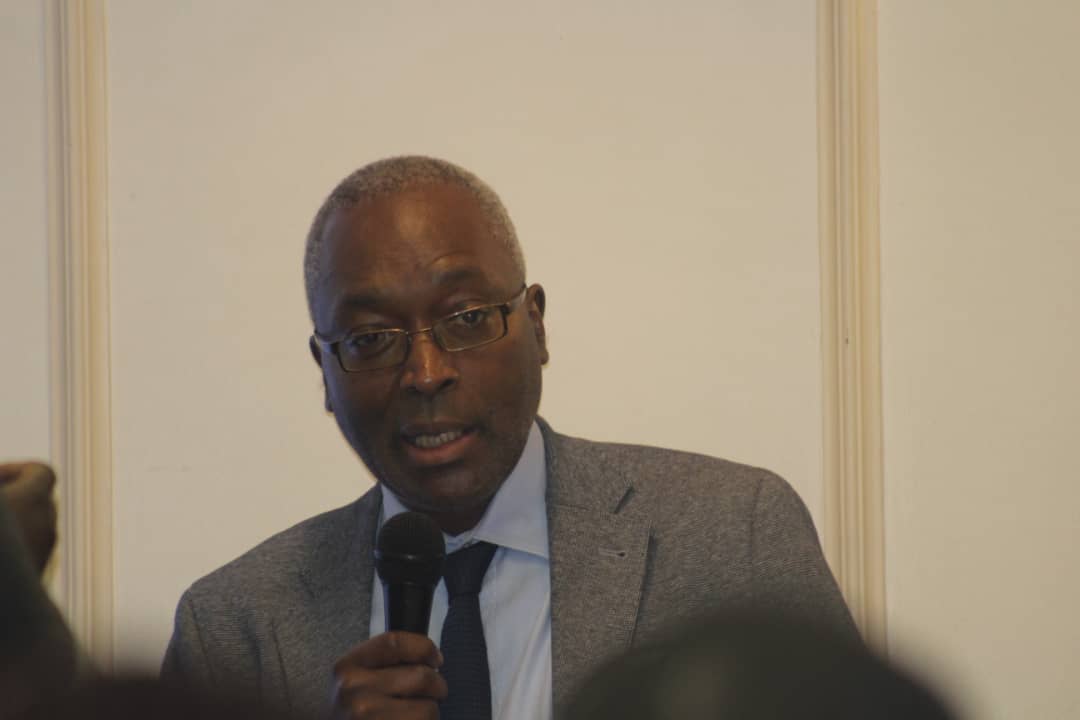

Presenting a bullish first half monetary policy statement, central bank governor, Dr John Mangudya said the stability of the rate, which was reduced from 70 percent last November, would help re-build confidence in the economy.

“Following Monetary Policy Committee (MPC) deliberations, the bank reduced its policy range on overnight accommodation from 70 percent to 35 percent, effective 20th November 2019, in order to promote confidence in the economy and minimise non-performing loans,” he said.

“At its meeting held on 14 February 2020, the MPC resolved to maintain the policy rate at 35 percent per annum.”

The apex bank said it expects the economy to grow by three percent.

Dr Mangudya said month-on month inflation is targeted to be below five percent by year end in line with the bank’s thrust of stabilising the economy.

He said Zimbabwe’s inflation had runaway in the last half of last year following currency reforms implemented by government that saw re-introduction of the Zimbabwe dollar as a mono-currency.

“Stabilising the negative shocks of – cost of adjustment – that emanated from the economic reforms that the country went through in 2019 in its quest to right-size or re-balance the economy is necessary for rebuilding confidence with the Zimbabwean citizenry and for creating a conducive economic environment for sustainable growth,” the central bank governor said.

Following introduction of a local currency, government last year suspended the production of annual inflation statistics, which is now expected to resume in March.

Dr Mangudya said the bank was keeping liquidity supply in check, with ZW$1.1 billion in notes and coins having been in circulation as at the end of December 2019, out of the ZW$34.5 billion in bank deposits.

About 200 businesses controlled 50 percent of the bank deposits.

“The bank will continue to gradually increase the notes and coins to the desired optimal proportion of bank notes and coins in circulation of up to 10 percent of deposits agreed by the MPC to meet cash demand,” he said.

“Moreover, the bank will gradually introduce notes in larger denominations to improve efficiency and convenience to the public.”

The cash in circulation at the moment amounts to about 3.2 percent of total deposits.

New Ziana