Zim conducts first Treasury Bill auction in a decade

Share

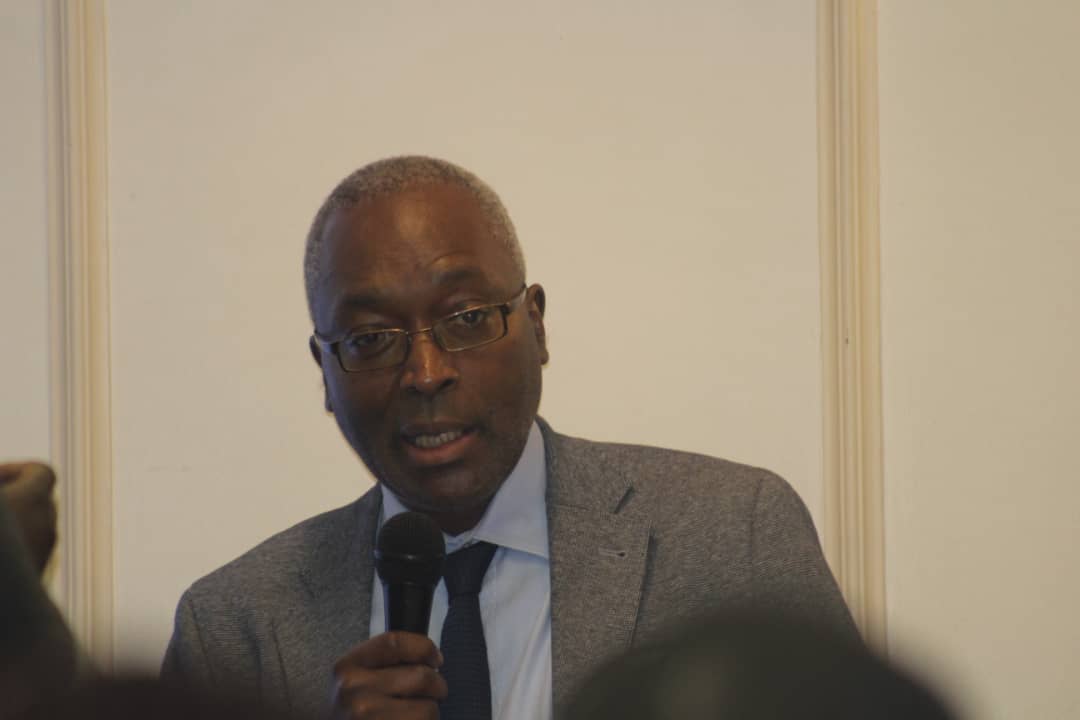

The Zimbabwean government on Tuesday conducted its first Treasury Bill (TB) auction in over a decade, described by Finance and Economic Development Minister, Mthuli Ncube as setting the foundation for plans to mobilise long term funding through an infrastructure bond.

Professor Ncube could not immediately share how much government intended to mobilise via the infrastructure bond. TBs are one of the ways through which a government can mobilise funds to support its activities by selling the bills to investors for a specified period, with the investors being repaid, with interest, at the period the instrument matures.

At Tuesday’s auction in which three TBs were auctioned, Prof Ncube

said government, through the Reserve Bank of Zimbabwe, only took about

ZWL$18 million of the ZWL$80 million that was offered by participating

bidders, mainly banks.

The TBs had 91-day, 182-day and 365-day maturities at interest rates

of 16.5 percent, 19.6 percent and 17 PERCENT respectively.

“The purpose of this auction was to test the market in terms of

appetite for a Treasury Bill auction and to begin to map up the yield

curve,” Prof Ncube told journalists.

“We need a yield curve in the market which will then allow us to

launch the longer term dating bonds but also as a way for pricing

other asset classes within the market.”

But with government saying it was in a cash positive position since

the beginning of the year, Prof Ncube said the money mobilised through

the first auction was not out of necessity.

“This is how we tested the market. Why are we raising the money,

frankly, we do not need the money (at this stage),” he said.

“We really want the money for longer-term bonds, which is the

infrastructure bond.”

Prof Ncube said it was also necessary for the market to have more

instruments that will allow investors to enjoy high interest rates.

“This (the auction) is already telling us about the shape of the yield

curve and where long term interest rates are going so that when we

issue an infrastructure bond, we have an idea as to the kind of

pricing we should accept as government when the market responds to the

placement of this long term infrastructure bond,” he said.

Prof Ncube hinted on the return of Treasury Bill auction last year,

arguing there was need for diversity in the financial markets.

New Ziana