ZSE in new exchange deal

Share

Harare, (New Ziana) – The Zimbabwe Stock Exchange (ZSE) said on Wednesday it had signed a memorandum of understanding with a local company for the development of a “receivables” financing platform.

The partnership, with Harare Receivables Exchange Limited (HRE) is part of the local exchange’s strategy to widen options for local companies to raise working capital.

On its website, HRE says it “provides investors with a secure, efficient and transparent way to trade short term receivables. At the same time, we provide our clients with a cost-effective way to liquidate receivables to grow their businesses.”

Receivables, which are regarded as assets in accounting, are debts owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

In this regard, HRE’s role will be to advance capital to a business against its invoices or receivables.

“We simplify structured trade finance tools for the use of everyday working capital needs. This facilitates financial inclusion and improves the conversion cycles of cash within the business and the economy,” HRE says on its website.

“We provide strong analytics and reporting capabilities that capacitate our client’s management to make the right business decisions to improve profitability.”

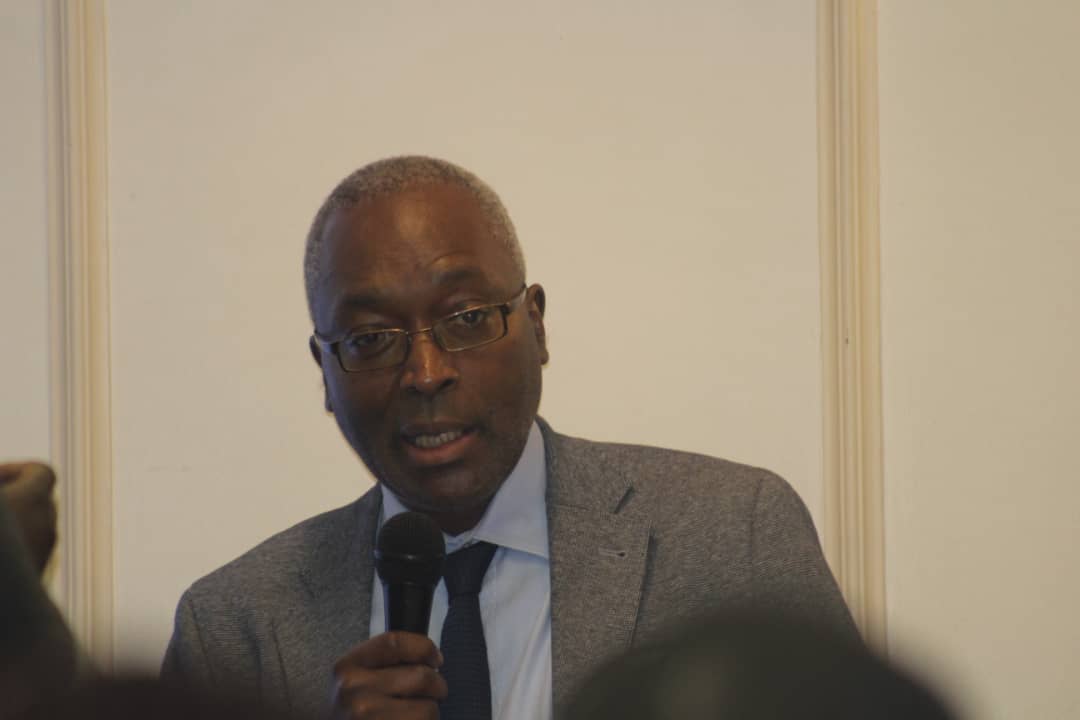

ZSE chief executive, Justin Bgoni said signing of the MOU formed the basis for the bourse and HRE to establish a framework in the development of a receivables financing platform.

“As the ZSE, we are delighted to be partnering with HRE, and we envision that over time, the receivables financing platform will grow to offer additional products that will provide the wider market working capital and other forms of financing,” he said.

“This collaboration will entail both parties having joint responsibilities in the establishment of a trading platform for receivables.”

Only last week, the ZSE signed yet another MOU with local financial institution, GetBucks for the establishment of an alternative bourse for formally registered companies small to medium enterprises that will be known as the Zimbabwe Emerging Enterprise Market.

The partnership with HRE, Bgoni said, will help facilitate the country’s economic development.

“The ZSE is looking forward to a successful partnership with HRE in ensuring the growth of the receivables financing platform,” the ZSE boss said.

New Ziana