Caledonia continues to spread its footprint

Share

Harare (New Ziana) – A few months after purchasing Bilboes Gold Mine in Bulawayo, Caledonia Mining has added a new asset, Motapa Mining, to its growing portfolio as it pursues an aggressive growth strategy in Zimbabwe.

In its quest to become a multi-asset producer, Caledonia, whose flagship is the Blanket Mine in Gwanda, first acquired Maligreen gold fields in Gweru last year, before buying Bilboes Mine for US$53.3 million, and now Motapa, which is situated next to Bilboes.

In a notice, Caledonia said it is buying Motapa from the Bulawayo Mining Company, a privately owned United Kingdom based company, for an undisclosed amount which is below the regulatory disclosure threshold.

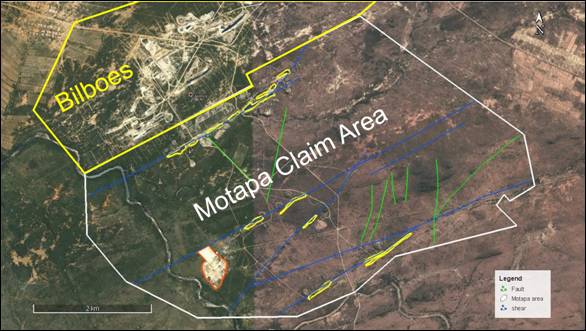

Caledonia considers Motapa, which has a mining lease covering approximately 2 200 hectares, to be highly prospective and strategic to its growth ambitions in Zimbabwe.

“The Motapa asset has been mined throughout most of the second half of the 20th century. Caledonia Mining understands that during this period the region produced as much as 300 000 ounces of gold. Whilst none of the mining infrastructure remains, the evidence of historical mining will provide guidance to our exploration team in best understanding the prospectivity of the region,” the company said.

Commenting on the acquisition, Caledonia chief executive officer Mark Learmonth said the company acquired Motapa because of its large scale, and excellent geological prospectivity and also its strategic location adjacent to Bilboes.

“Motapa was a high priority acquisition for Caledonia. We look forward to developing an exploration program for Motapa as we target a large-scale gold belt surrounding the Bilboes project,” he said.

“With the central shaft at Blanket now fully operational and production targeting 80 000 ounces of gold per year, we anticipate that we will deploy the incremental cash flow arising from Blanket into our exciting exploration and project development portfolio in Zimbabwe.

“The acquisition of Motapa following the signing of a sale and purchase agreement to acquire Bilboes and the acquisition of Maligreen demonstrates that over the last 12 months Caledonia has established a pipeline of high-quality exploration and development projects. This is in addition to the potential for further growth at Blanket where we are optimistic about its exploration potential.”

Motapa, which is approximately 75 km north of Bulawayo, was formerly owned and explored by Anglo American Zimbabwe before it exited the Zimbabwean gold mining sector in the late 1990s.

Speaking at a media briefing in July, Learmonth said Caledonia was excited with the opportunities available in the local gold sector.

“There are other assets that we continue to look at in Zimbabwe. We have got a very aggressive growth strategy in Zimbabwe. At this stage we are not looking at anything else outside Zimbabwe. The reason is we believe Zimbabwe is highly prospective for gold, is massively under explored and we are here, and we know how to operate here, so why on earth would we take our money somewhere else where we do not know how to operate?

“The critical thing, apart from being highly prospective for gold, what sets Zimbabwe apart is the quality and ability of the workforce, we have got 2 000 people at Blanket Mine all of them Zimbabweans. Zimbabwe has a lot going for it and that is why we are perfectly willing to spend our money and to try and raise more money to invest in our growth in Zimbabwe. For us it is a no brainer,” he said then.

The expansion by Caledonia is one of several projects that are expected to spur the attainment of a US$12 billion local mining industry by 2023.

Under the roadmap, gold production of 100 tons and earnings of US$4 billion per annum are expected to anchor the attainment of the US$12 billion milestone.

New Ziana