RBZ approached to review withdrawal limit

Share

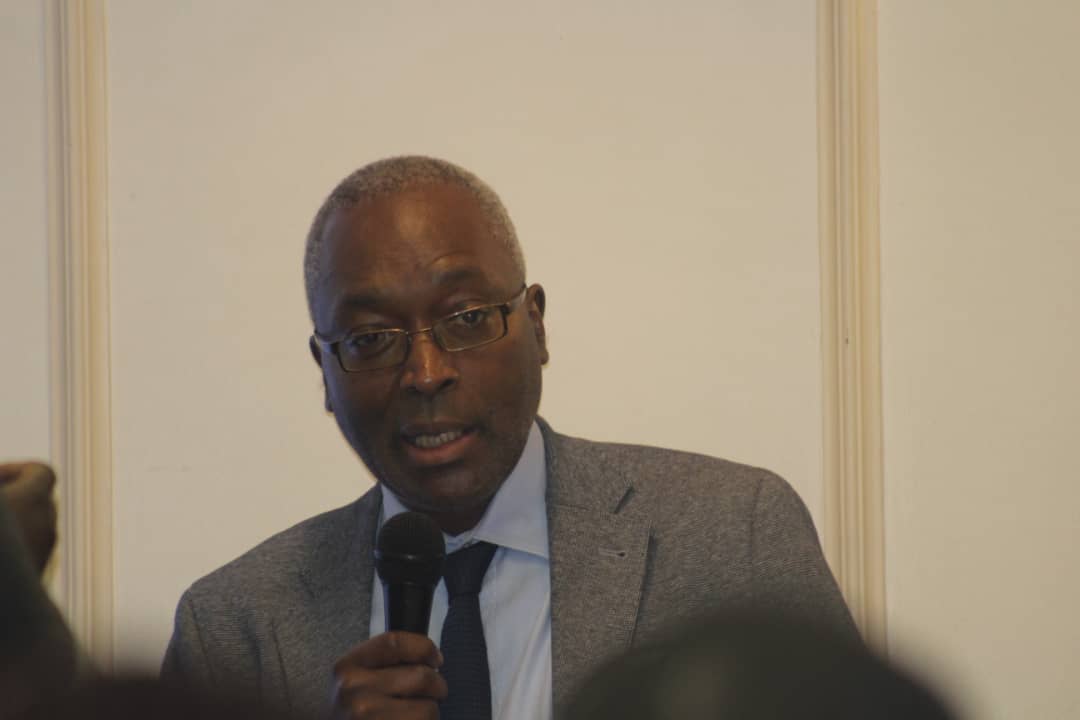

Harare (New Ziana) –Finance and Economic Development Minister Mthuli Ncube says he has approached the Reserve Bank of Zimbabwe to review the maximum cash withdrawal limit of RTGS$5 000 to a more meaningful amount and to respond to inflationary pressures.

He said this in the National Assembly on Wednesday during the question and answer session.

Ncube was responding to a question from Kadoma Central legislator Muchineripi Chinyanganya who wanted to know the measures that the government was taking to address the plight of pensioners, who he said were spending more than five days queuing at banks to withdraw their meagre pension payouts.

“I have approached the Central Bank to review that limit of RTGS$5 000 so that the amount withdrawn per day is more meaningful and also just to respond to inflationary pressures.”

“That is being dealt with in addition to the measures that individual banks are taking.”

Ncube conceded that pensioners were experiencing challenges in accessing their monthly pensions in banks, singling out CABS, the National Building Society (NBS), POSB, Steward Bank and NMB.

He said CABS was using a new banking system which pensioners were not well versed with, hence most were failing to withdraw their income using

ATM cards and consequently, tellers spent more time assisting clients on how to use the new system.

There was also resistance to new technology by pensioners, as some insisted on getting cash from the banks instead of using ATM cards for purchasing goods and services, he explained.

Ncube went on to outline the various strategies that some banks had introduced to reduce queues, such as incentives for pensioners to transact using their bank cards, including applying zero charge for such transactions.

He said CABS had introduced Super Agencies in Norton, Chitungwiza, Budiriro, Highfield and Greendale to assist in cash withdrawals, adding that currently the bank was conducting an awareness campaign through road shows, radio and websites.

Starting next week, the NBS would be operating a special banking hall in Bulawayo, and it was collaborating with Metro Peach Supermarket to serve pensioners as its agent.

With queues usually long in the morning, some banks had made deliberate strategies to open at 7 am and by midday, they would have cleared the long queues.

Ncube said NMB had introduced a virtual withdrawal system where the client accessed all the banking services digitally and went to the banking hall to provide the reference number to the teller.

Steward Bank had introduced the Steward Bank “Vanyarikani queue” where the elderly and physically challenged were prioritised.

Shurugwi North legislator Ronald Nyathi urged Ncube to consider removing the cap on withdrawals for all pensioners since the majority were from rural areas.

“Certainly when I have further conservations with the Reserve Bank, I will put that on the table so that they mull over it,” Ncube responded.

New Ziana