RBZ standardises export retention for all sectors

Share

Harare, (New Ziana) – The Reserve Bank of Zimbabwe (RBZ) on Friday set the foreign currency retention threshold for all exporters at 70 percent with immediate effect.

The move is part of wider measures to promote productivity and sustain the foreign currency auction system.

Previously retention thresholds for exporters were set at different levels depending on the lobbying from the different sectors was.

Early this year miners were allowed to keep 70 percent of their hard cash, up from 55 percent while tobacco farmers retained only 50 percent

with the rest disposed off at the ruling exchange rate.

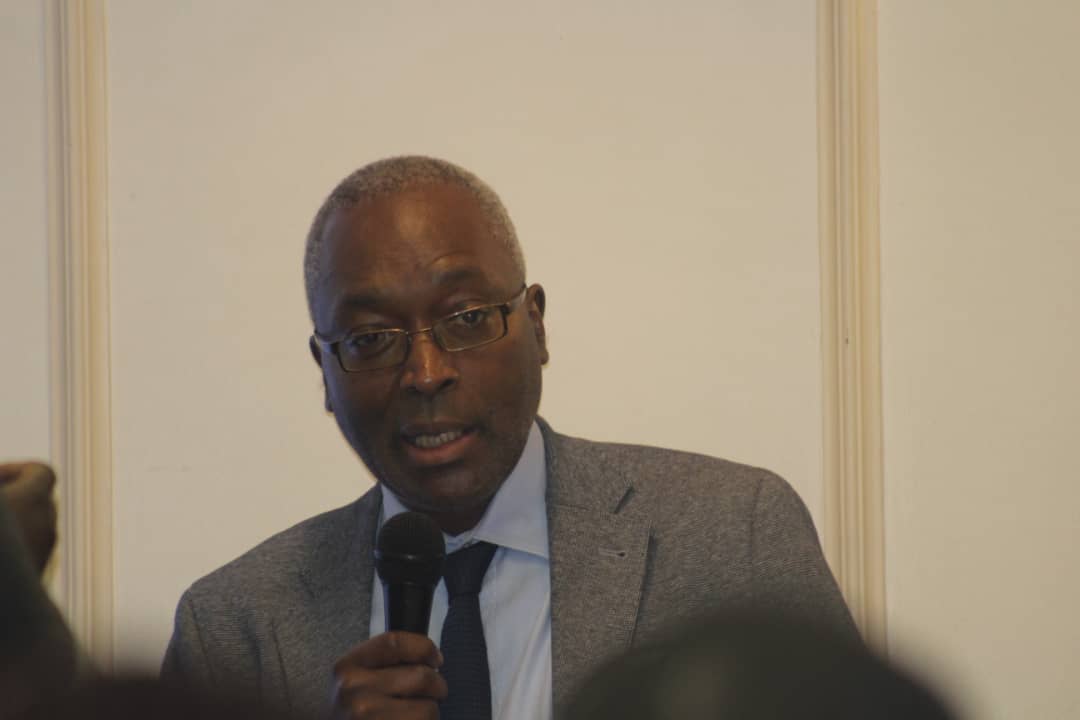

Central Bank Governor, Dr John Mangudya said the period for liquidation of unutilised foreign currency balances had also been increased to 60 days from 30.

“Given the positive impact of the auction system in price stability and the need to sustain the auction, all export retention thresholds for all exporters will be at a standard level of 70 percent with immediate effect,” he said while presenting the monetary policy statement.

“In addition to this equity principle on export retention thresholds, the 30 day liquidation period of unused funds has been reviewed upwards to 60 days from the day of receipt of funds. This is essential to enable exporters to better manage and plan their cashflows.”

Introduced in June this year, the foreign currency auction system has been lauded for bringing about stability in the economy through availing hard currency to productive sectors at affordable rates.

Previously, the parallel market was the main source of foreign currency for companies, but it was accessed at a premium.

At least 30 percent of the exporters funds would be availed to productive sectors at the running exchange rate.

And as part of further measures to sustain the auction system, the central bank said 20 percent of the foreign currency receipts of providers of goods and services shall be liquidated at the point of depositing in domestic foreign currency accounts.

“For the avoidance of doubt, all existing balances in the Domestic FCAs will not be affected by this policy,” Dr Mangudya said.

Meanwhile, the central bank said domestic foreign currency account balances had grown to US$405 million at the end of July from US$352 million in January this year as a sign of growing confidence in the economy.

New Ziana